What is the Excise Vape Tax?

Starting October 1st, 2022, the Canadian Federal government will be imposing a new tax on all eliquid across Canada.

The Canadian Excise tax applies to other non-vape related industries such as Tobacco, Cannabis, & Alcohol.

Eliquids will now be subject to an Excise tax, increasing their price. This excise tax will start at $1 per 2 mL of eliquid in each container up to 10 mL, plus $1 per 10 mL of eliquid above that.

Starting January 1st, 2023 it will be mandatory for all eliquid products.

Important Dates:

- January 1st 2023 all retail EZ-Vape locations will sell excise compliant products.

- We anticipate having many products excise tax-free up until January 1st 2023.

*As certain product sells out we will be stocking Excise compliant products in their place.

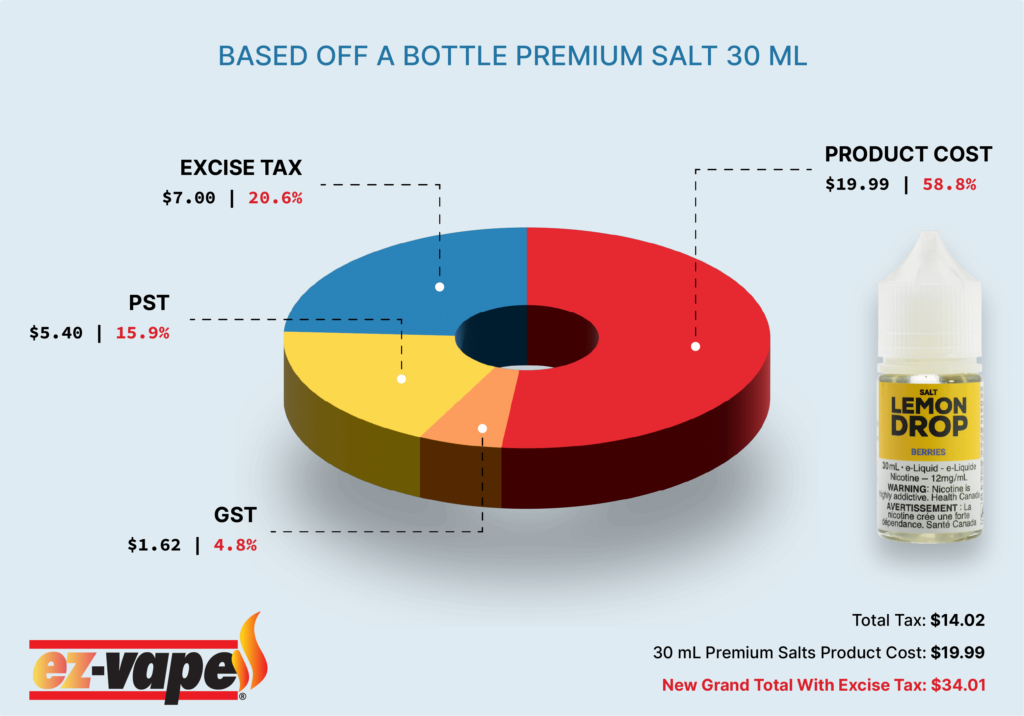

Here is a visual breakdown of how the new excise tax will affect a Premium 30 mL bottle of Salt Nicotine eliquid:

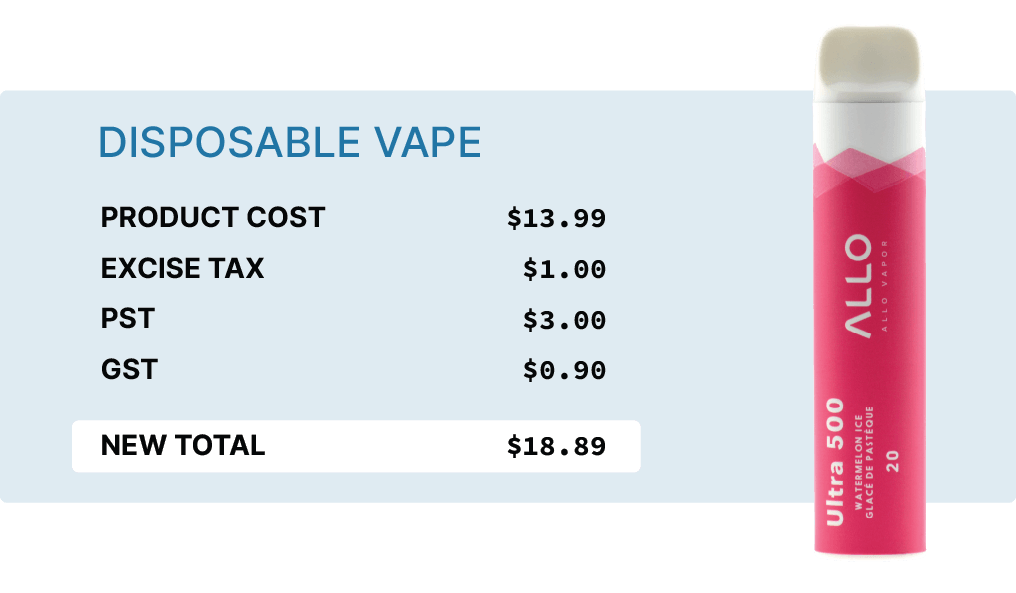

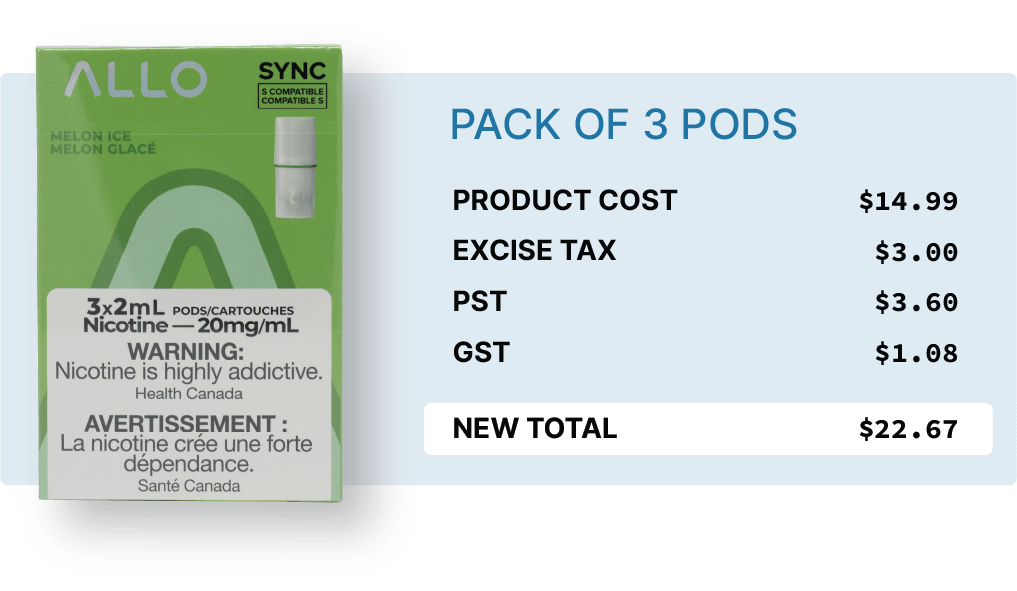

We break down how that will look for both our store pricing of Pods & Disposables below.

Breakdown of Excise Applied to a Single Disposable Vape:

Breakdown of Excise Applied to a Pack of 3 Pods (2 mL each pod):

All EZ-Vape stores will follow compliance in accordance with the new Excise Tax regulation.

Please be kind and respectful to all staff members and employees of EZ-Vape as this is Federally mandated for all vape products across Canada.